Rivian Drops After Guggenheim Cut, but Retail Investors Stay Optimistic

On Monday, Guggenheim analyst Ronald Jewsikow lowered his rating for electric vehicle manufacturer Rivian Automotive (RIVN) to 'Neutral' from 'Buy', pointing to weaker long-term projections for the R2 and R3 models due to lower-than-expected R1 sales and unfavorable shifts in U.S. electric vehicle and emission policies.

Rivian Currently produces consumer vehicles known as R1, such as the R1T pickup truck and the R1S sport utility vehicle. The business is set to introduce additional car models, including the R2 sport utility vehicle and the R3 crossover.

The Guggenheim continues to be assured about achieving cost-cutting goals for the R2. However, the company now lacks assurance regarding the necessary production levels and/or expected average selling price (ASP) needed to justify the previous price estimate, according to an analysis shared with investors through TheFly.

Reducing R1 demand has a slight adverse effect on R2 and R3 sales, and the removal of electric vehicle subsidies is expected to hurt long-term average selling prices and/or sales growth, according to the company.

This month, Rivian announced that it shipped 10,661 cars during the second quarter, reflecting a drop of 23% compared to the same time frame in 2024.

The firm manufactured just 5,979 cars at its plant in Normal, Illinois, during this time frame, a decrease from the 9,612 units made in the second quarter (Q2) of 2024.

The firm reiterated its projected vehicle delivery target for 2025, which stands between 40,000 and 46,000 units, marking a decrease from the 51,579 vehicles sold in 2024.

The R1S sports utility vehicle and the R1T pickup have price tags approximately reaching $70,000. Rivian additionally offers electric delivery vans for commercial clients, including Amazon.com Inc., with costs averaging about $80,000.

However, the R2 SUV is anticipated to cost approximately $45,000 and will face competition from Tesla Inc.'s (TSLA) top-selling Model Y SUV upon its release during the first half of 2026. Production of the R3 crossover is set to begin afterward.

The firm is presently engaged in building activities at its Normal facility to get ready for R2 manufacturing. Rivian is also set to halt operations at its Illinois factory for roughly a month during the latter part of the year in preparation for launching R2 production.

In the meantime, President Donald Trump enacted the Republican tax legislation into law on Independence Day. Under the new law Tax incentives for purchasing electric vehicles will end on September 30. This covers the $7,500 federal tax break for buying a new EV and the $4,000 credit for acquiring a pre-owned one.

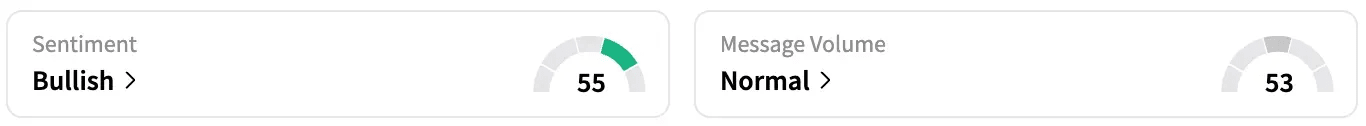

During the period, retail enthusiasm for Rivian stayed in the 'bullish' range over the last 24 hours, although the level of messages decreased from 'high' to 'normal'.

The RIVN stock has declined by 5% so far this year and more than 27% in the last 12 months.

Read Next: AZ Stock Gains After Investigational Medication Reduces Hypertension in Advanced Trial, Retail Sector Still Unresponsive

To get the latest information and changes, send an email to newsroom[at][dot]com.

Posting Komentar untuk "Rivian Drops After Guggenheim Cut, but Retail Investors Stay Optimistic"

Please Leave a wise comment, Thank you