New Gambling Tax Rule Targets Top Bettors in Arkansas – Here's the Inside Scoop

A forthcoming federal tax regulation set to begin in 2026 may alter the way certain gamblers declare their gains and losses. A casino in Arkansas claims this could affect a modest yet significant segment of its clientele.

The adjustment is included in President Donald Trump's "Large, Stunning Law." Although most recreational gamblers won't be impacted, Saracen Casino Resort states they are closely monitoring its potential effect on specific patrons.

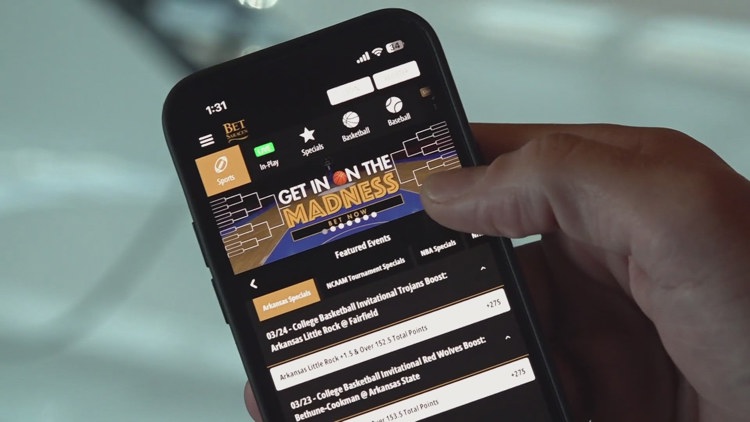

Bet Saracen is ranked as the 13th biggest online sports betting platform in the U.S., processing over $300 million in bets annually.

The typical stake placed at Saracen through the sportsbook is approximately $30 — which I refer to as a 'skin-in-the-game' bet," stated Carlton Saffa, the casino's head of marketing. "Do we accept big wagers? Yes, individuals have placed hundreds of thousands of dollars on specific games. However, the main point is that our tens of thousands of monthly active users are what I classify as leisurely, small-bet gamblers.

Beginning in 2026, individuals who gamble will only be eligible to claim a deduction for 90% of their losses, limited to the total amount they have won. This represents a shift from the present regulation, which permits a complete 100% deduction.

Saffa mentioned that the majority of Saracen users won't notice any impact.

"If you're someone who places wagers, like making a few bets on Sundays for the NFL and some on Saturdays for college games, the chance of this affecting your taxes significantly is practically nonexistent," he stated.

Actually, Saffa mentioned that only about a dozen players at their casino might be affected.

That reflects a small portion of a small portion of a small portion of our wagers," Saffa stated. "In short, this isn't devastating for the industry. It might impact just a few gamblers in Arkansas. However, regardless of everything else, we do care about those few individuals.

Nevertheless, the casino remains firm on this matter. Saracen is backing a bill introduced by Rep. Dina Titus from Nevada, who is part of the Congressional Gaming Caucus.

They are our clients, and among our most significant ones," Saffa stated. "In line with that perspective, I want to inform you that we back Representative Titus' bill, which is now moving toward the Ways and Means Committee in Congress, aimed at restoring the deductions to 100%.

As per government representatives, those who win the lottery are not likely to be impacted. They mention that it is uncommon for individuals participating in the lottery to deduct their losses from their wins.

The updated regulation will take effect starting January 1, 2026.

Posting Komentar untuk "New Gambling Tax Rule Targets Top Bettors in Arkansas – Here's the Inside Scoop"

Please Leave a wise comment, Thank you